COVID-19 brought on a wave of predictions: infection rates, stock market losses, supply chain and production challenges. The list goes on and on. It’s next to impossible to consume the news without seeing another prediction about how we will experience the “new normal.” The good news is that in uncertain times, predictions can help us make better decisions and plan for the future. In business analytics and marketing, this process is “predictive analytics.”

Defining Predictive Analytics

According to SAS Institute, predictive analytics is the use of data, statistical algorithms and machine learning techniques to identify the likelihood of future outcomes based on historical data. The goal is to go beyond knowing what has happened to provide the best assessment of what will happen in the future. Predictive analytics already is one of the most widely adopted intelligent automation technologies in the world. More than 80 percent of major enterprises are deploying smart analytics, according to Statista.

Predictive analytics can mean a world of difference when it comes to assessing marketplace risks and opportunities. However, to be useful, combine predictive analytics with a forward-looking strategy. That means adhering to a data-driven decision-making process that aligns with your company’s mission and vision. Rob Stillwell, senior vice president of Seacoast Bank, worked with SAS and says, “It was important to lead with asking, ‘What is the objective, strategically, of our company? What questions do we want solved?’ If you say, ‘Let’s just start gathering data,’ you might not be going down the best path.” In today’s market, predictive goals can include planning for recovery, incorporating new digital solutions that connect with prospects and considering the viability of remote workplaces. Predictive analytics may uncover a variety of opportunities and changes that are available. It’s up to those involved to use that data to prioritize and make informed decisions.

Practical Tips for Implementing a Predictive Marketing Strategy

Now more than ever, it’s essential to assess current data to make the best choices to impact the future of your company, prospects and clients. Consider these tips as you incorporate predictive analytics and forward thinking into your business and marketing strategy.

- Acknowledge market disruptions and assess the current market. Investopedia defines a market disruption as “a situation wherein markets cease to function in a regular manner, typically characterized by rapid and large market declines…the disruption creates widespread panic and results in disorderly market conditions.” COVID-19 is an unprecedented market disruption. COVID-19 contributed to job loss, investment changes, new regulations and halted spending. When it comes to predictive analytics, it’s important to start with a foundational market understanding. While it is returning to normal, the market is different now, and your company is too.

- Evaluate your software and analytics tool options. Predictive analytics cover a wide variety of statistical techniques including data mining, predictive modeling and AI and machine learning. Choose the types of analytics that work best for your company. Utilize software and algorithms or outsource to experts when necessary, such as SAS Advanced Analytics, which uses innovative algorithms. Board, combines business intelligence, integrated business planning and predictive analytics applications on a single software platform. Another example is RapidMiner, a data-science platform with renowned AI.

- Analyze historical purchase and engagement data to understand buyer personas. It’s important to have a foundational understanding of the nature of the marketplace and how your company fits into it. Then consider your customers’ previous purchase and engagement data in comparison to the present. It’s vital to look at this data with context. Buyer actions will look vastly different before COVID-19 and after. According to Sebastian Stan, a digital strategist from Cognetik, “Since the COVID-19 outbreak, consumer behavior started shifting rapidly and significantly altered normal patterns. This mostly impacts business forecasts, such as trends or KPIs forecasts that depend on volatile market conditions. Predictive analytics and these algorithms at work enhance the cost-effectiveness of business decisions. Predictive analytics also increases model sustainability by analyzing massive amounts of data. Everything from stock moves, customer behavior, and algorithmic trading are being handled by data scientists.” To understand these changes, follow trends and spikes to determine the goods and services your clients need right now and how they allocate their budgets. Use this data to recognize the buyer personas of your target markets, and what they’re doing to navigate the changes in the market. Consider what types of content and platforms they’re engaging with to best understand how, where and at what frequency to communicate with clients and prospects.

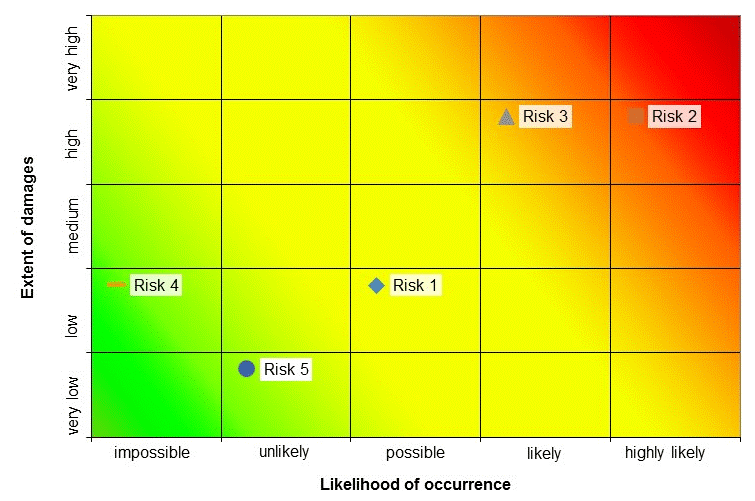

- Understand risks and associated challenges and measure profitability. In addition to analyzing the actions of your clients and prospects, it’s important to pay attention to risks and opportunities. This is especially vital when budgets are tight, personnel is limited and buyers are hesitant. Use a “risk matrix” to visualize risk in a diagram. In the diagram below, the risks are divided depending on their likelihood and their effects or the extent of the damage. This allows for the worst-case scenario to be determined at a glance.

Is Predictive Analytics Part of Your Arsenal?

Predictive analytics can help shape planning for recovery and improvement. As the world begins to recover from the impact of COVID-19, companies across all industries need actionable plans and forward-looking strategies to help them adjust to both short and long-term changes. Advanced analytics and market research expert Anil Kaul informs, “Analytics can drive a successful response to the immediate crisis, but it’s important not to lose focus on long-term objectives. Now is the time to make plans for disruptions of various lengths and the resulting economic fallout, which could include a lasting recession, or, more optimistically, a period of disruption followed by a rapid recovery.” The bottom line? If you haven’t adopted predictive analytics into your arsenal yet, now is the time.